Intelligent Automation, zCase Study

AR Cash Processes Automation for a Leading French Real Estate Company

atif | Updated: October 6, 2023

The client, a distinguished family-owned appliance company, has maintained market leadership for over three decades. With eight showrooms across Northern California, they offer a wide range of top-notch appliances from renowned brands.

Client Background:

Our client is a prominent French commercial real estate company specializing in the management of prime assets in the world’s most dynamic cities. Their portfolio includes office buildings, shopping centers, and airport retail facilities.

Challenges

The client faced significant challenges in their Accounts Receivable (AR) Cash management processes. These challenges included:

- Manual Workload: The AR Cash management process involved a substantial amount of manual effort, especially in handling inbound receipts from various sources such as Wire transfers, ACHs (Automated Clearing House), and Returns.

- Receipt Identification: The update process required precise identification of incoming receipts and their allocation to the correct tenant accounts. This involved handling a diverse range of transactions.

- Cash Application: The client needed a solution to streamline the application of cash to tenant accounts efficiently. This required integrating Direct Match and Auto-Apply programs into their workflow.

Trantor Solution

Trantor provided an innovative solution by implementing AR Cash Process Automation, which addressed the client’s challenges comprehensively. Here’s how our solution worked:

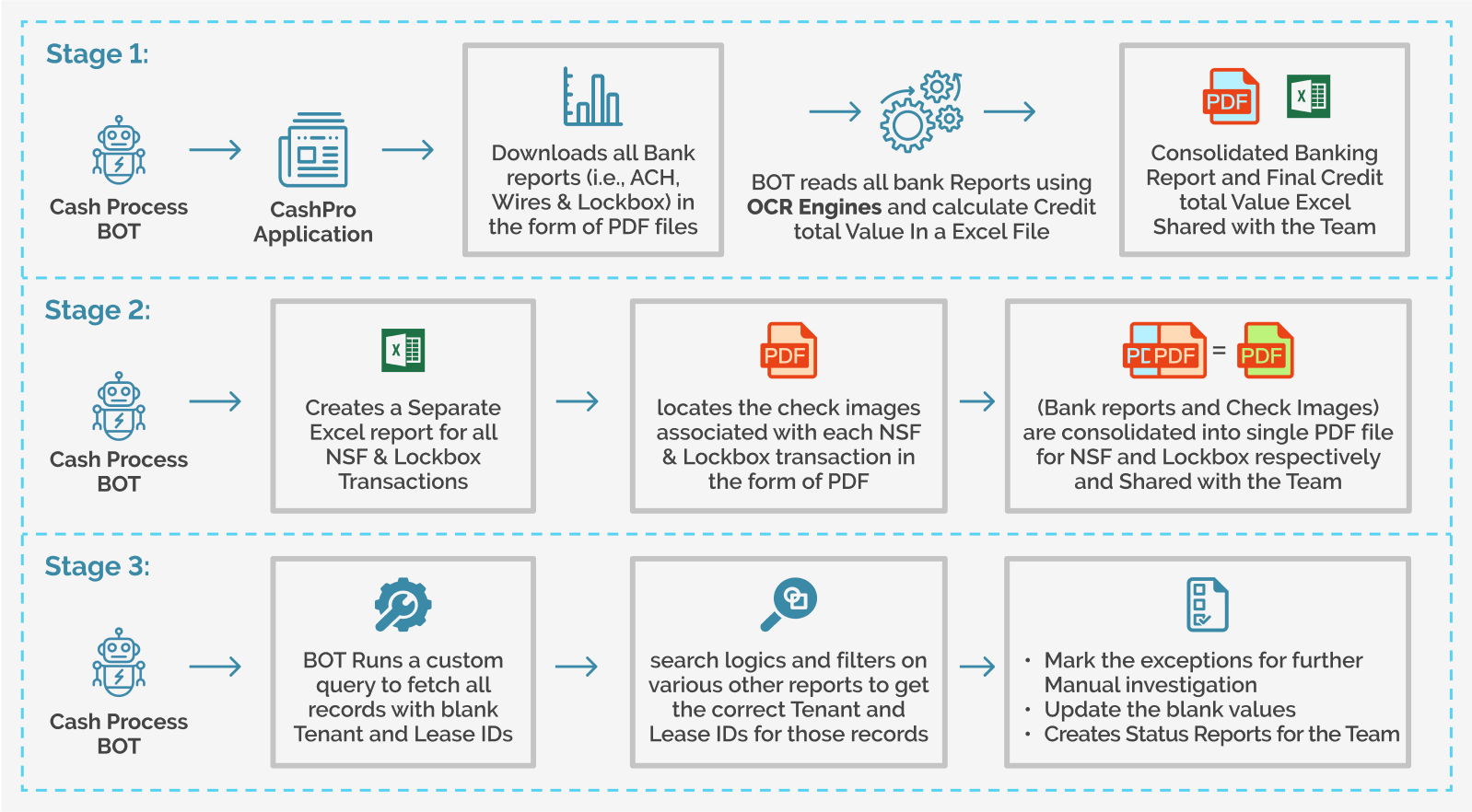

- Automated Reports: We automated the process of downloading banking reports and Lockbox reports (including ACH, NSF, and Wires) through scheduled tasks, eliminating the need for manual intervention.

- Bank Account Insights: We created a comprehensive report that provided an overview of all bank accounts, including the total credit. This improved visibility into the client’s financial operations.

- Receipt Analysis: Our solution focused on analyzing incoming non-portal receipts from tenants and accurately matching them to their respective accounts. This was achieved by leveraging the capabilities of Direct Match and Auto-Apply programs.

- Error Clearance: We implemented a process to clear all unapplied cash in the final report. Our goal was to ensure that the report was error-free, with zero outstanding discrepancies.

Outcomes:

The implementation of Trantor’s AR Cash Process Automation BOT brought about significant improvements for our client:

- Key Success Factor – Cash Reconciliation:Cash reconciliation between CashPro and JDE (JD Edwards EnterpriseOne) was now a seamless and accurate process.

- Manual Effort Reduction: The solution resulted in a substantial reduction in manual effort. Previously, the AR Cash management process required 20 hours per day of dedicated work. With our automation, this workload was drastically reduced to just 2 hours per day.

In conclusion, Trantor’s AR Cash Process Automation not only resolved the client’s manual challenges but also optimized their cash management processes, leading to increased efficiency, accuracy, and overall operational excellence. This transformation empowered our client to focus on their core real estate operations while ensuring their financial processes were aligned with industry best practices.