RPA, zBlog

RPA in Accounting & Finance Industry – Top 15 Real World Use Cases of Automation

trantorindia | Updated: January 17, 2023

Robotic Process Automation (RPA) has recently gained traction in the accounting and finance industry. With the ability to automate repetitive and mundane tasks, RPA has the potential to improve efficiency and accuracy within the accounting field significantly.

Programmable software “bots” assist accountants in completing crucial but tedious and time-consuming tasks related to audit, attest, and tax work. Like advanced Microsoft Excel macros, these bots can work across multiple applications but can handle a larger volume of data, including general-ledger or ERP tasks involving significant manual data entry. RPA (Robotic Process Automation) improves efficiency by automating many types of manual processes and does so faster than traditional macros.

Unlike human employees, RPA has no work-hours limitations. Bots can run 24/7/365, increasing productivity to levels traditional workers could never achieve. Firm leaders appreciate the increase in productivity, which offers them a competitive advantage with clients. Let’s discuss the top 15 use cases of RPA in the accounting and finance industry:

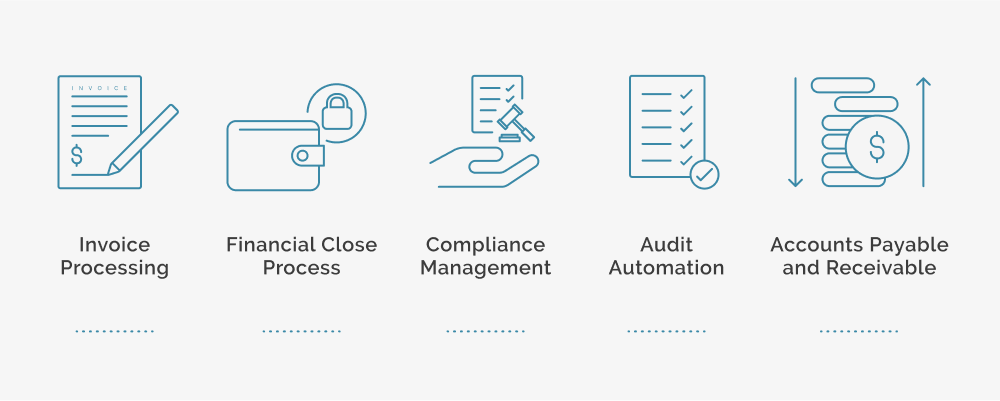

- 1. Invoice Processing: One of the most common use cases of RPA in accounting is automating invoice processing. This involves using RPA bots to collect data from invoices, verify the information, and then upload it into the accounting system. This can significantly reduce the time and effort required for manual data entry and improve the information’s accuracy.

A major retail company used RPA to automate their invoice processing process and reduced the time required for the process by 80%, from an average of 5 days to just one day. This resulted in a significant reduction in labor costs and improved the accuracy of the invoice information. - 2. Financial Close Process: RPA can be used in the immediate financial process. This includes tasks such as account reconciliation, journal entry posting, and balance sheet analysis. By automating these tasks, RPA can help speed up the immediate financial process and improve the accuracy of financial statements.

A financial services firm used RPA to automate their immediate financial process and reduced the time required for the process by 50%, from an average of 10 days to just five days. This helped improve the accuracy of the financial statements and enabled the finance team to focus on more strategic tasks. - 3. Compliance Management: RPA can also automate compliance management tasks, such as preparing and filing tax returns. This can help ensure that the necessary paperwork is completed on time and complies with relevant laws and regulations.

A multinational manufacturing company used RPA to automate its compliance management tasks, such as preparing and filing tax returns. They reduced the time required for these tasks by 60%, from an average of 8 days to just three days. This helped ensure compliance with relevant laws and regulations and reduced the risk of fines and penalties. - 4. Audit Automation: RPA can also be used in auditing. This includes tasks such as data extraction, data analysis, and report generation. Automating these tasks can help improve the efficiency of the audit process and also help to reduce the potential for errors.

A major accounting firm used RPA to automate its audit process and reduced the time required for the process by 40%, from an average of 15 days to just nine days. This helped improve the audit process’s efficiency and reduced potential errors. - 5. Accounts Payable and Receivable: Automating Accounts Payable and Accounts Receivable is another area where RPA can be used. This includes invoice matching, vendor statement reconciliation, and payment processing. By automating these tasks, RPA can help improve these processes’ efficiency and reduce potential errors.

An IT company used RPA to automate their accounts payable and receivable processes and reduced the time required for the operations by 75%, from an average of 7 days to just 1.75 days. This resulted in an improvement in the efficiency of these processes and also a reduction in the potential for errors.

- 1. Invoice Processing: One of the most common use cases of RPA in accounting is automating invoice processing. This involves using RPA bots to collect data from invoices, verify the information, and then upload it into the accounting system. This can significantly reduce the time and effort required for manual data entry and improve the information’s accuracy.

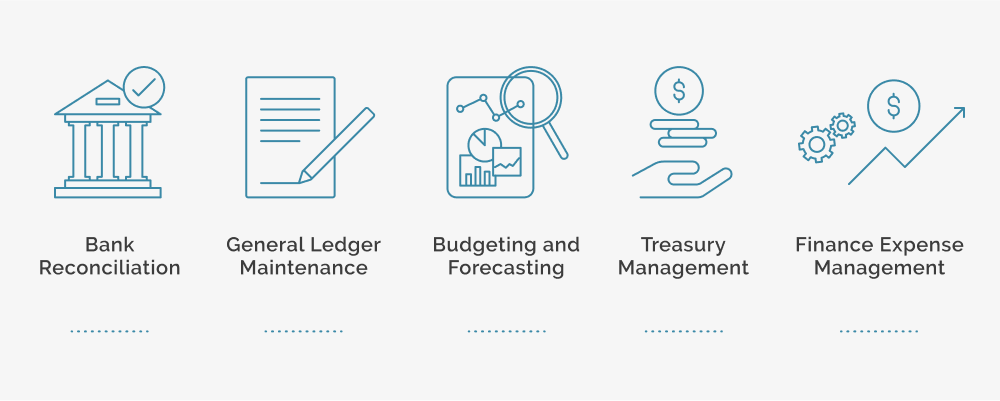

- 6. Bank Reconciliation: RPA can be used to automate the bank reconciliation process. This includes tasks such as comparing bank statements with accounting records to ensure that all transactions are accounted for. By automating this process, RPA can help speed up the reconciliation process and reduce potential errors.

For example, a European bank implemented RPA for their bank reconciliation process and reduced the time required for the process by 70%, from an average of 15 days to just four days. - 7. General Ledger Maintenance: RPA can be used to automate the maintenance of the general ledger. This includes tasks such as posting journal entries and reconciling account balances. By automating these tasks, RPA can help to improve the efficiency of the general ledger maintenance process and reduce the potential for errors.

For instance, a major US-based accounting firm used RPA to automate their general ledger maintenance process and reduced the time required for the process by 60%, from an average of 10 days to just four days. - 8. Budgeting and Forecasting: RPA can be used to automate the budgeting and forecasting process. This includes tasks such as data collection, data analysis, and report generation. By automating these tasks, RPA can help to improve the efficiency of the budgeting and forecasting process and reduce the potential for errors.

A European-based Pharmaceutical company was able to automate its budgeting and forecasting process using RPA. It achieved a 30% reduction in the time required for the process, from an average of 5 days to just 3.5 days. - 9. Treasury management: Though sophisticated information systems are in place, initial data input is often performed manually. Bots can extract and transform data into a format a treasury system can process, and even more: Extracting and formatting data, Updating treasury systems, Sending out reports, and General ledger updates are some of the common tasks that BOTS can do.

- 10. Finance Expense Management: The Use Case validates employee expenses submitted in different invoice formats like PDF, PNG, JPEG, etc. This Use Case can be automated using OCR or advanced Document Extraction concepts with a combination of artificial intelligence.

- 6. Bank Reconciliation: RPA can be used to automate the bank reconciliation process. This includes tasks such as comparing bank statements with accounting records to ensure that all transactions are accounted for. By automating this process, RPA can help speed up the reconciliation process and reduce potential errors.

- 11. Remediating discrepancies: Once bad data enters the enterprise data ecosystem, it can quickly spread to multiple systems and data repositories. This can result in significant downstream data cleaning and correction work. RPA helps to automate this process quickly and efficiently by scanning the data, finding issues, and bringing them to a team member’s attention for review. Finally, once the correct data is identified, a bot can programmatically correct the data issue across all impacted systems.

- 12. Policy Documents and Request List Creation: Automating the policy documents and request list creation process in accounting can greatly improve efficiency and accuracy. By using software, “bots,” or RPA (Robotic Process Automation) technology, tasks such as data entry and document formatting can be automated, reducing the need for manual labor and minimizing errors.

This automation can also streamline the approval process by automatically routing documents to the appropriate parties for review and approval. Additionally, with the use of automation, data can be easily updated and managed in real-time, providing a more accurate and up-to-date view of the organization’s policies and requests. Overall, the automation of the policy documents and request list creation process can lead to high costs and time savings for the organization. - 13. Tax Return Data Consolidation Process: Automating the tax return data consolidation process in accounting can significantly improve efficiency and accuracy. Using software “bots” or RPA (Robotic Process Automation) technology, data from various sources can be consolidated and automatically populated into tax return forms, eliminating the need for manual data entry and reducing the risk of errors. The automation also allows for real-time data tracking and monitoring, ensuring that all relevant information is included in the tax return. This can save a significant amount of time for the organization, as well as reduce the risk of errors and ensure compliance with tax regulations. Additionally, the automation process can provide better visibility and control over the data, support decision-making, and comply with regulatory requirements.

- 14. Employee Timesheet Creation: This automation can also streamline the process by allowing employees to input their hours, enabling managers to approve or reject timesheets quickly and track each timesheet’s status. Additionally, the automation process can provide better visibility and control over the data to support decision-making, such as payroll processing, project tracking, and cost management. Automating the employee timesheet creation process can lead to significant cost and time savings for the organization and can also ensure compliance with labor regulations.

- 15. E-files Status Log Creation: This automation can also streamline the process by allowing the system to automatically log and track the status of e-files in real time, providing a more accurate and up-to-date view of the organization’s files. Additionally, the automation process can provide better visibility and control over the data to support decision-making, ensure compliance with regulatory requirements, and support internal control processes. Automating the e-files status log creation process can lead to high cost and time savings for the organization while ensuring compliance with regulatory requirements.

In conclusion, RPA is a powerful tool that can be used to automate a wide range of tasks in the accounting industry. From invoice processing and immediate financial process to compliance management and audit automation, RPA can help improve efficiency and accuracy while reducing potential errors. As the technology continues to evolve, we will likely see even more use cases of RPA in the accounting industry in the future.

Trantor’s state-of-the-art RPA experts have assisted Global organizations in using RPA’s power to generate considerable cost savings, enhanced compliance, and increased productivity. We leverage our extensive expertise in intelligent automation to achieve your desired business outcomes efficiently.

Trantor’s state-of-the-art RPA experts have assisted Global organizations in using RPA’s power to generate considerable cost savings, enhanced compliance, and increased productivity. We leverage our extensive expertise in intelligent automation to achieve your desired business outcomes efficiently.

Our intelligent process optimization approach is based on a lean methodology, focusing solely on implementing solutions that bring the most value to your organization. We employ the most advanced business process automation framework to identify where you are in your automation journey and then provide value-driven, tool-agnostic, and vendor-agnostic solutions.